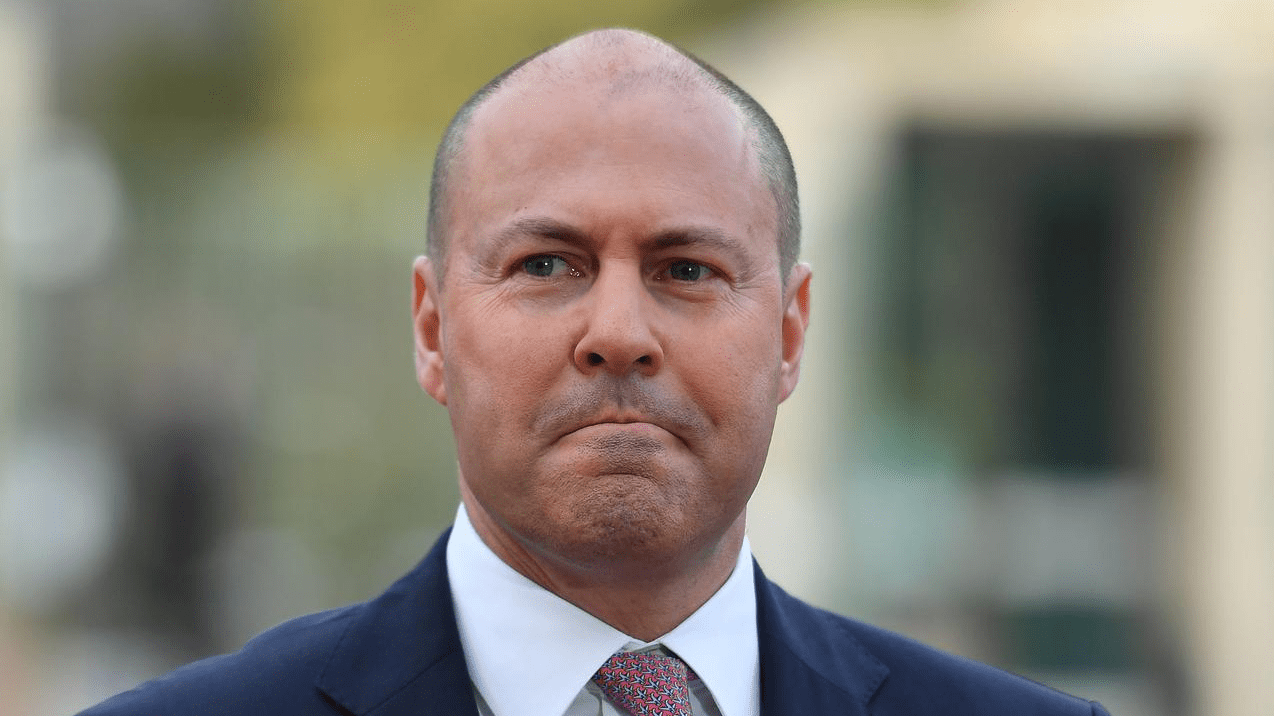

Treasurer Josh Frydenberg said the Australian Government’s regulatory proposals for cryptocurrencies would be “the most significant reforms to our payments system in 25 years”. The government plans to consult on future cryptocurrency reforms in 2022.

According to Mr Frydenberg, the government will also investigate the potential development of a central bank digital currency.

A central bank digital currency (or CBDC) is a digital form of a country’s official fiat currency.

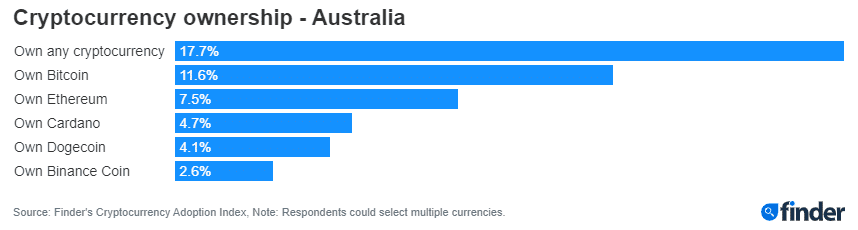

According to a survey from Finder, almost one in five Australians owns some form of cryptocurrency. Finder also says Australia has the third highest rate of cryptocurrency ownership in the world.

Of those surveyed who did own a cryptocurrency, 65.2 per cent owned bitcoin. Bitcoin is the most popular and highest-valued coin currently on the market.

Mr Frydenberg said he hopes that tightening regulations around the trading and use of cryptocurrencies in Australia may “give consumers a little bit more certainty and confidence about the parties that they’re dealing with”.

“For businesses, these reforms will address the ambiguity that can exist about the regulatory and tax treatment of crypto assets and new payment methods,” the treasurer said.

“In doing so, it will drive even more consumer interest, facilitate even more new entrants and enable even more innovation to take place.”

“Australia must retain its sovereignty over our payment system. These are significant shifts that we need to be in front of,” said Mr Frydenberg.

The details of the reforms to be established are still being drafted to be further specified in next year’s consultation period.

In discussing plans for cryptocurrency in 2022, Mr Frydenberg said ‘buy now, pay later’ companies, such as AfterPay and ZipPay, would likely also see tighter regulation in future.