Earlier this month, the European Parliament Committee on Economic and Monetary Affairs voted against the ban on Proof of Work (Pow) cryptocurrencies, but with the 2nd largest cryptocurrency, Ethereum set to make a move from PoW to Proof of Stake (PoS), experts believe it won’t be long before others follow suit.

Markets in Crypto Assets (MICA) submitted to the committee a bill that would provide a uniform legal framework, consumer protection and environmental sustainability goals for cryptocurrencies in Europe. MICA put forward the idea to introduce a ban on PoW based cryptocurrencies such as Bitcoin and Ethereum, as well as implementing legislation that would require crypto producers to comply with environmental guidelines.

Although the ban was removed from the bill, it was noted by MEPs that “Mechanisms used to validate transactions in crypto-assets have a substantial environmental impact, particularly for proof-of-work mechanisms”. The committee also remarked that the energy consumption of Bitcoin is “equal to that of entire small countries”.

In 2021 it was noted by Microsoft founder Bill Gates that “Bitcoin uses more electricity per transaction than any other method known to mankind”. A Bitcoin Energy Consumption Index on Digiconomist.net revealed that as of February 2022, the annual electrical energy footprint of Bitcoin was 204.50 terawatt-hours (TWh) which is equivalent to the national power consumption of Thailand.

With a figure like that, it’s understandable that energy consumption from cryptocurrencies will eventually need to be reduced however one crypto is already taking that step with Ethereum in the midst of switching from PoW to PoS in a transition called ‘The Merge’. Ethereum will conduct a highly technical transition away from the process of ‘mining’, using high powered processors to solve mathematical problems, to operate under a PoS system which will significantly reduce energy consumption by up to 99.95 per cent.

According to Motley Fool, Proof of Stake is when “owners of the cryptocurrency can stake their coins then the protocol selects a validator who adds a new block of transactions and earns rewards”. This change could be broken down to simplistically, being likened to depositing funds into a secure bank account as collateral and receiving a small percentage of the banks’ transaction fees as a reward.

We spoke to Ethereum advocate #Ultrasoundmoney on Twitter, who said there were other significant benefits above reduced power consumption, including,

“-10x reduction in issuance from 15K ETH/day to 1.5K ETH/day

– 5x increase in economic security (from $8B to $40B)

-Penalties to deter and recover from 51% attacks”.

In this context, ‘issuance’ refers to the amount of new token supply created by the network. If Ethereum were to reduce issuance by 90 per cent, this is likely to have a profound impact, effectively reducing Ethereum’s inflation by around a mind-boggling AUD$60,000,000 per day at today’s prices.

While Ethereum is set to move to PoS, Bitcoin developers have been largely silent about a potential transition to a more environmentally sustainable mechanism. Senior Lecturer of Business Information Systems at the University of Queensland Dr Christoph Breidbach, explained to NewsCop what effect removing PoW might have on cryptocurrencies on Bitcoin.

“First of all, please keep in mind that there will be no more than 21 million Bitcoin available [and] as of today, approximately 18.9 million Bitcoin have already been mined, and we are adding approximately 900 Bitcoins/day,” he said.

“Another 1.3 million Bitcoin are expected to be mined before 2024 [and] by 2025; we would therefore have mined approximately 95 per cent of all Bitcoin,

“And while mining Bitcoin will be more ‘difficult’ from a technical point of view over time (the last Bitcoin is expected to be mined in the year 2140), banning Bitcoin mining post-2025 would have extremely limited effect on the supply and availability of Bitcoin in circulation,

“Second, a much better way of thinking about why the EU might ban crypto mining has to do with regulation,

“All decentralized financial applications represent an inherent threat to the stability of fiat currencies and the sovereignty of nation-states and central banks – and with that power, of major political and societal institutions,

“Money is power, and whoever controls money has power. As we have seen already, it is difficult – if not impossible, to regulate and control cryptocurrencies like Bitcoin,

“If you can’t beat them, join them’ seems to be the approach taken by countries like El Salvador, who made Bitcoin legal tender,

“I believe the EU is attempting to go down another route,

“They can’t effectively regulate Bitcoin/crypto, but they are trying to limit its availability (of new coins) by outlawing mining – using the ‘environmental angle’ as a, frankly, cheap narrative.”

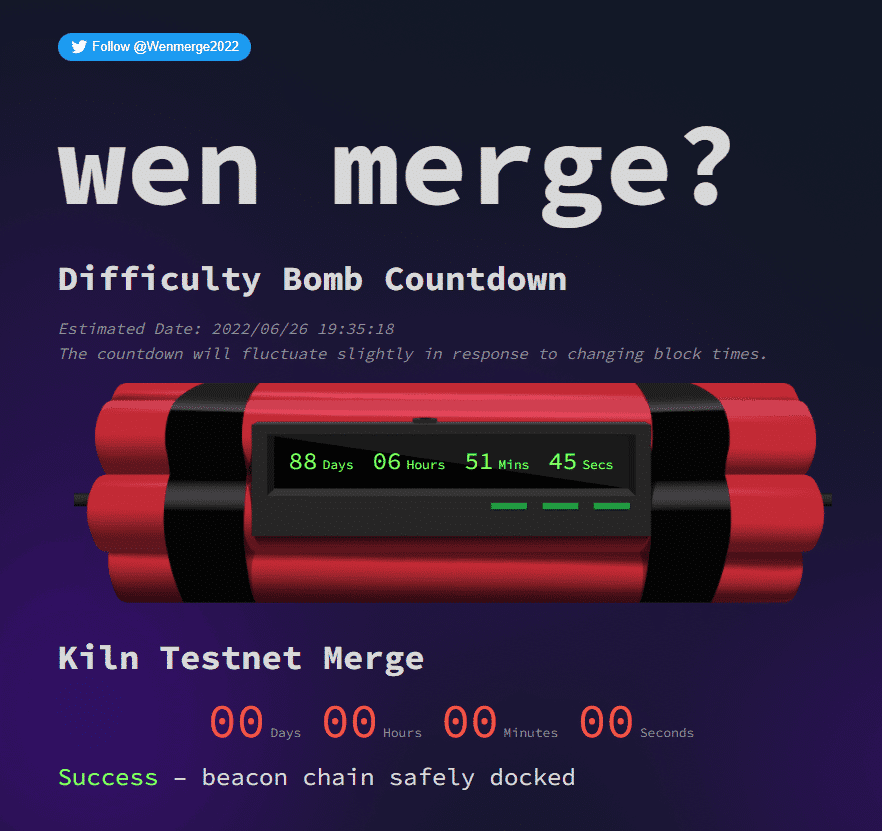

While there is no exact date as to when The Merge will happen, NewsCop talked to Twitter user @WenMerge2022, who informs crypto enthusiasts on ‘The Merge’ about when eager crypto enthusiasts can expect it to happen.

“At the moment, there is a programmed date to encourage the switch from Proof of Work (energy-intensive problem solving) to Proof of Stake,” they said.

“This was extended in December 2021 by an update called Arrow Glacier to come into effect on around 28th June 2022 [and] when this is triggered, commonly known as the ‘difficulty bomb’, solving the problems required [by] Proof of Work will become less profitable and eventually unviable,

“The upgrade named ‘Bellatrix’, commonly known as the merge, appears to be going well in testing,

“Developers have been understandably reluctant to talk timeframes in their calls, but progress does suggest a mainnet release sometime around June/July 2022 to coincide with the difficulty bomb being triggered as more likely than not.”

Twitter user # wenmerge2022’s updates on the merge can be found here: https://wenmerge.com/