In consultation with President Joe Biden, the Federal Deposit Insurance Corporation (FDIC) and the Federal Reserve boards approved the FDIC’s resolution of SVB.

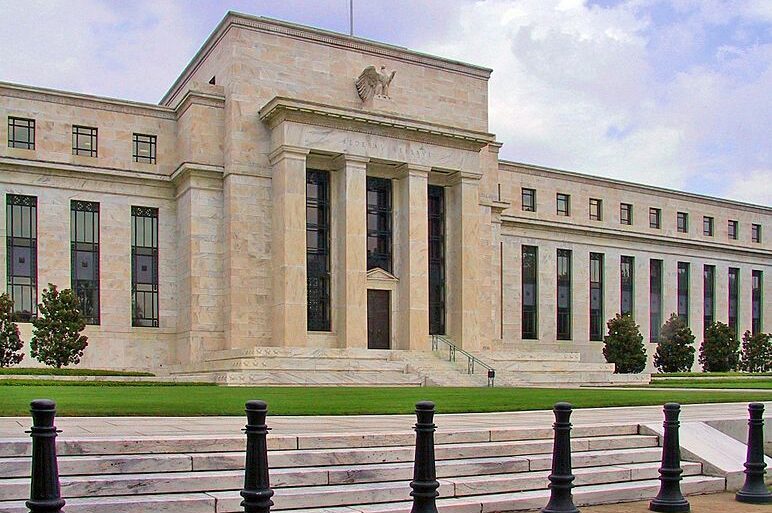

The move was announced in a joint statement by US Federal Reserve Chair Jerome Powell, Treasury Secretary Janet Yellen, and FDIC Chairman Martin Gruenberg on Sunday evening in the US.

According to the statement, the actions will not lead to a loss for American taxpayers, and all deposits will be made whole.

“Today we are taking decisive actions to protect the U.S. economy by strengthening public confidence in our banking system,” says statement. “This step will ensure that the U.S. banking system continues to perform its vital roles of protecting deposits and providing access to credit to households and businesses in a manner that promotes strong and sustainable economic growth.”

The full statement can be read here.

A senior official for the US Treasury said the move was only to protect depositors, and that firms would not be bailed out.

During the official’s briefing with the media, they said that SVB equity and bondholders would be wiped out

They also said that the Biden administration would continue working with Congress and financial regulators if additional measures were needed to strengthen the country’s financial systems.

The Federal Reserve also announced that state regulators have shut down New York Signature bank.

New York Department of Financial Services Superintendent Adrianne Harris announced in a statement that the FDIC had taken receivership of NYS, an action deemed necessary “to protect depositors.”

“Signature Bank is a New York state-chartered commercial bank and is FDIC-insured, with total assets of approximately $110.36 billion and total deposits of approximately $88.59 billion as of December 31, 2022,” says Harris’ statement. “DFS is close contact with all regulated entities in light of market events, monitoring market trends, and collaborating closely with other state and federal regulators to protect consumers, ensure the health of the entities we regulate, and preserve the stability of the global financial system.”

Harris’ full statement can be read here.

Notable is that the closure of SVB and Signature would have serious implications for the crypto sector.

The price of the second largest cryptocurrency stablecoin, USD Coin (USDC), dropped by over 10% over the weekend after The Centre consortium announced that US$3 billion of funds were locked in SVB.

USDC’s value is designed to be pegged 1:1 to the US dollar. However, its value dropped dramatically to less than 90 US cents after the announcement. Since the Federal Reserve announced its measures to protect deposits, the value of USDC appears to have re-pegged.

Signature was seen as one of the few crypto-friendly banks in the US, even after it announced it would be reducing its exposure to the crypto-industry a few months ago.

Some customers considered it the last on-ramp and off-ramp for the crypto industry, terms meaning to convert real cash (fiat currency) into cryptocurrency.