Bitcoin and Ethereum are the world’s two most popular cryptocurrencies. Source: Flickr.

Australia appears to be faring better than most countries when it comes to inflation rates but sound money could be the answer to solving this global issue.

Inflation rates in Australia are much lower than other countries such as the US but the effect can still be felt on the economy. With the US experiencing a 40-year high inflation rate of 7.5 per cent and the UK not far behind, we reached out to one of Australia’s leading expert economists Saul Eslake to ask why Australia appears to be faring better.

“Australia isn’t seeing the sharp rise in electricity prices that is a major reason for the rise in inflation in the UK and, to a lesser extent the euro area- both of which rely much more heavily on natural gas to generate electricity than we do, and who therefore have been much more affected by rising natural gas prices than we have,” he said.

Mr Eslake went on to state why the US is also experiencing such high inflation rates.

“In the US, measured CPI inflation is being pushed higher by the way they measure housing costs for owner-occupiers, which is based on the notional ‘imputed rent’ that owner-occupier pay themselves for the housing services they consume, which accounts for about 22 per cent of the US CPI,” he said.

“Whereas by contrast in Australia, owner-occupier housing costs are measured in the CPI by new dwelling construction costs (i.e., inflation of land prices excluded) and it only accounts for about nine per cent of the CPI,”

“House price inflation has a much bigger impact on the US CPI than Australia’s.”

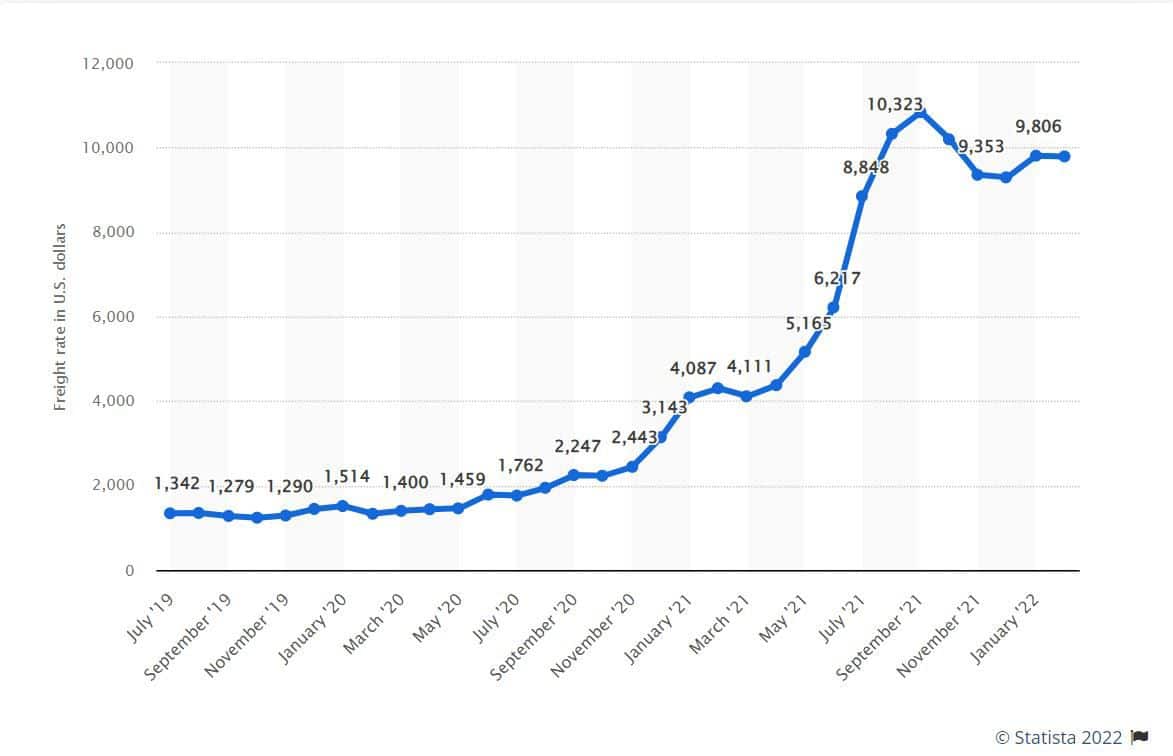

Although Australia’s inflation rates aren’t nearly as high as the US or UK, Mr Eslake said that he expects that inflation rates in Australia will rise due to the increase in global shipping costs.

Inflation is largely managed in modern times by the central bank’s monetary policy which influences the supply of money. Chairman of the Swiss National Bank (SNB) Dr Thomas Jordan commented at length on the concept of ‘sound money’ at a Swiss economic conference in 2020.

He said a central banks distributing currency offered advantages by giving a degree of flexibility to affect the supply in response to the demand while attempting to keep the value stable over time.

“This flexibility, in crisis situations a central bank can make an important contribution to damage limitation by supplying additional money to avoid a shortage of liquidity,” he said.

He went on to say “However, things start to get dangerous when it is misused to solve political or structural problems by issuing central bank money”. “The temptation to fulfil such wishes via the printing presses, by creating money out of thin air, is of course all the greater the more politicised monetary policy becomes”.

Not long after, the Swiss Financial Regulator (FINMA) formally approved the countries first crypto market investment fund. SEBA Bank CEO stated that the fund would provide liquidity options to institutional investors such as banks and insurers wishing to access cryptocurrencies.

WIth regard to cryptocurrencies in general the SNB Chairman Dr Jordan has previously said “I would look at them more as an investment than a currency.” and “There are a variety of interesting potential uses for digital tokens – including, for example, privately issued digital tokens in the form of stable coins, as well as state-issued digital token money for financial market participants.”

With ongoing inflation in the US, many countries (El Salvador, Mexico, Ukraine, Paraguay, Honduras), multi-nationals (Tesla, Block, Microstrategy), billionaires (Elon Musk, Peter Thiel, Ray Dalio) and increasingly the general public are looking for alternatives to provide financial stability.

A hot, trending topic is the adoption of cryptocurrencies, with increasing commentary around the use of cryptographic forms of ‘sound money’ as legal tender.

An important element of what might make cryptocurrencies ‘sound money’ is that they offer a fixed currency supply, differing from the US dollar for example, where supply can be expanded to meet demand.

In the world of cryptocurrency Bitcoin has been dubbed sound money by many of its growing army of supporters. With El Salvador already enacting laws to recognise Bitcoin as legal tender, Mexican Senator Indira Kempis announced a similar bill with the world watching as to which country will take the leap next.

Bipartisan Senators in both Texas and California are widely advocating for the introduction of a ‘Bitcoin Bill’ suggesting one may be introduced in the US as early as this year. Australia’s neighbour Tonga is looking to be one of the next adoptees with Lord Fusitu’a, a former Tongan MP saying a bill to make Bitcoin legal tender is due to be voted on in May 2022 and is confident the Bill will pass.

We spoke to Michaela Juric also known as Bitcoin Babe on Twitter, who participated in the Australian Senate inquiry into cryptocurrency and digital assets with Senator Andrew Bragg.

“Even in countries where financial systems and government treasuries are lacking infrastructure, regulation, and trust, Bitcoin can offer more financial stability than fiat currencies,” she told NewsCop.

“While we often hear about the benefits of decentralization and the freedom it gives citizens to achieve “financial freedom,” the real test will be whether or not Bitcoin is accepted as legal tender in countries where the economy is seen as more robust.”

She went on to say that “According to a number of experts, Dubai is set to become the next country to accept Bitcoin as legal tender.”

“Dubai’s economy shares a heavy dependency on tourism, and so implementing a “Global Currency” like bitcoin in conjunction with the lightening network would allow tourists to worry less about cash, travel cards, currency exchange outlet availability, or credit cards, allowing for a more enjoyable vacation experience, without the worry of FX rates and fees,”

“Solar-powered mines in the desert, could be a lucrative source of revenue for their government, given that there are no capital gains or income taxes.”

The second largest cryptocurrency, ‘Ethereum’, has coined the term ‘Ultra Sound Money’ as its own version to ‘Sound Money’.

We reached out to @ultrasoundmoney?? on Twitter about the concept.

“The idea of ultra sound money is for ETH, the native currency of Ethereum, to distinguish itself as an internet money via a shrinking monetary supply—the opposite of government money. The decreasing supply happens via a process called “the burn”,” they told NewsCop.

“The more vibrant the Ethereum economy becomes, the larger the burn,”

“Ethereum has burnt on average $34M per day,”

“This dynamic reinforces ETH as a collateral instrument, increasing the economic security of Ethereum based on proof-of-stake as well as boosting the economic bandwidth for decentralised finance.”

‘The Burn’ can be watched live here https://watchtheburn.com/

Commercial and cryptocurrency law expert at the University of Auckland Associate Professor Alex Sims told NewsCop about the positives and negatives of the adoption in El Salvador so far.

“Saving money on commissions for remittances is a positive [and] so too is providing banking services for the unbanked, El Salvador had a particular problem with this,” she said.

“The identity theft issue involved implementation problems, so it wasn’t something inherent with Bitcoin (cryptocurrencies) as such,”

“The El Salvador experiment is still in its early stages, and it is too early to say whether it is a success,”

“The volatility of bitcoin is a problem, especially with a poor country such as El Salvador – but volatility is a lot lower with Bitcoin than a number of fiat currencies.”

Associate Professor Sims said that while some smaller economies that have a small number of bank accounts, volatile currencies and capital limits would be likely to adopt cryptocurrency as a legal tender, she believes it would be a very long time before large economies such as Australia, the US and UK would follow suit.

While widespread adoption of cryptocurrencies may appear to be a way off, more countries appear to be on the brink of transforming the way we think of money and inflation.